Just two weeks ago, the Saudi government announced that in September it will hit the international bond markets with a Dollar denominated issue. In the Kingdom’s history, this is the first foreign debt issue. Incredible though it may appear, the sheiks, holders of the world’s largest oil reserves, appear cash-starved. The Saudi monarchy that in 2011 was achieving an astounding fiscal surplus of 20% of GDP with zero public debt and sitting on over $700 billion of foreign reserves, has markedly seen its fortunes go into reverse since the oil price collapse in mid-2014. In 2015 the surplus morphed into a nasty deficit of up to 16% of GDP, public debt climbed to 10% while the currency reserves declined to below $ 600 billion. The Kingdom enacted even a few cuts in public expenditures, a measure unheard-of in the land of a guaranteed lifetime employment in the government sector.

In well-informed circles, the theory has been that the sudden decline in oil price was a deliberate strategy orchestrated by the Saudis, to kick the “shale oil” producers out of the market. Since the US producers rely heavily on debt and operate at loss when the oil price slips under $60 a barrel, such a plan could have worked. But it did not happen: with the Fed nailing interest rates around zero, the banks and the investment funds have continued to finance the drillers, who in turn have reduced production and cut costs. The result is that few drillers have effectively been pushed out of the market.

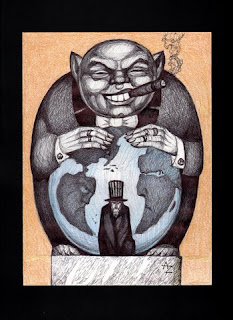

Now the Saudi strategy is backfiring and the big sharks of financial speculation are sharpening their teeth. The target is the fixed exchange rate between the Dollar and the Riyal (the Saudi currency). This monetary agreement between the two governments has lasted more than 30 years. The US economy and the Saudi elites have benefited immensely from it, with the latter accumulating sheer amounts of financial wealth.

The “Petrodollar” system worked in this way: US importers settled oil purchases only in Dollars at a stable, favorable exchange rate (by 1986 fixed at 0.26$ for 1 Riyal). In its turn, the Saudi Kingdom was committed to reinvest the profits in the US economy through the purchase of Treasuries, with the not negligible benefit of the guarantee of a continuous US military umbrella. All trades have been kept confidential for over 40 years till May 2016: neither the US nor the Kingdom has ever released detailed information about the involvement of the Saudis in the refinancing of US public debt.

In recent years, cracks have begun to surface in the apparently rock-solid deal. Thanks to the shale oil boom and the increasing market share of Iraqi and Iranian oil, the US is less dependent on the Saudis. The confidentiality shield has been lifted and finally the US Treasury revealed the amount of debt in the hands of the Kingdom: $120 billion, and it’s reasonable to believe that at least a further $ 100 billion are discreetly held offshore. In the meantime, the US Senate has allowed the victims of 9/11 to sue the Saudi Kingdom for its eventual responsibility for the attacks. All these moves can be interpreted as a progressive cooling in the US-Saudi political relationship.

Read more Saudi Arabia: The Next “Black Swan” For The Global Economy

In well-informed circles, the theory has been that the sudden decline in oil price was a deliberate strategy orchestrated by the Saudis, to kick the “shale oil” producers out of the market. Since the US producers rely heavily on debt and operate at loss when the oil price slips under $60 a barrel, such a plan could have worked. But it did not happen: with the Fed nailing interest rates around zero, the banks and the investment funds have continued to finance the drillers, who in turn have reduced production and cut costs. The result is that few drillers have effectively been pushed out of the market.

Now the Saudi strategy is backfiring and the big sharks of financial speculation are sharpening their teeth. The target is the fixed exchange rate between the Dollar and the Riyal (the Saudi currency). This monetary agreement between the two governments has lasted more than 30 years. The US economy and the Saudi elites have benefited immensely from it, with the latter accumulating sheer amounts of financial wealth.

The “Petrodollar” system worked in this way: US importers settled oil purchases only in Dollars at a stable, favorable exchange rate (by 1986 fixed at 0.26$ for 1 Riyal). In its turn, the Saudi Kingdom was committed to reinvest the profits in the US economy through the purchase of Treasuries, with the not negligible benefit of the guarantee of a continuous US military umbrella. All trades have been kept confidential for over 40 years till May 2016: neither the US nor the Kingdom has ever released detailed information about the involvement of the Saudis in the refinancing of US public debt.

In recent years, cracks have begun to surface in the apparently rock-solid deal. Thanks to the shale oil boom and the increasing market share of Iraqi and Iranian oil, the US is less dependent on the Saudis. The confidentiality shield has been lifted and finally the US Treasury revealed the amount of debt in the hands of the Kingdom: $120 billion, and it’s reasonable to believe that at least a further $ 100 billion are discreetly held offshore. In the meantime, the US Senate has allowed the victims of 9/11 to sue the Saudi Kingdom for its eventual responsibility for the attacks. All these moves can be interpreted as a progressive cooling in the US-Saudi political relationship.

Read more Saudi Arabia: The Next “Black Swan” For The Global Economy